What I call a Rich Problem to Have

The atrocity that is giving 6.4% more money to people making less than $10,000. I mean just look at how the transfer of wealth is going:

Seriously, when someone making $10,000 per year gets an extra $348 per year, this is not a reason to feel like someone is stealing from the rich.

Example: $10,000 ATax Income (assuming no income tax at all)

Pre-Obama 0% Tax Rate, $833/month

Enter Obama: -3.4% Tax Rate, $886/month

Net Monthly Gain: $53 - the cost of a single person's weekly grocery run.

Example: $500,000 BTax Income

Pre-Obama: 36% Tax Rate, $26,667/month

Obama: 39.4% Tax Rate, $25,250/month

Net Monthly Loss: $1,417 - 160% of the monthly income of the low-income example.

Sounds more like an argument for adding some kind of scale to accommodate living expenses for high cost areas. Although that sounds like a good way to create virtual gated communities using "cost of living" fences.

To put all of this into perspective:

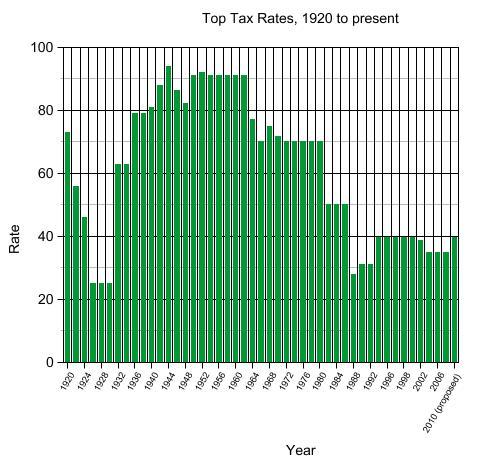

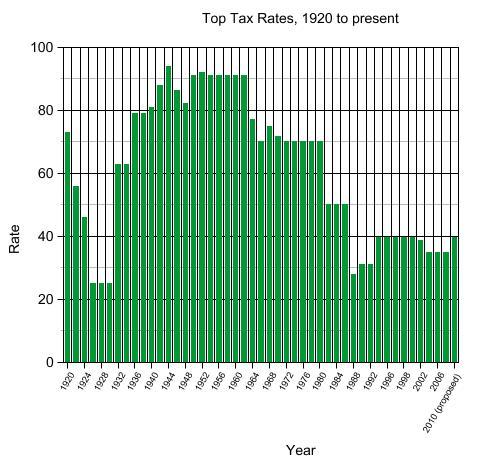

Historical tax rates have been substantially higher, and this country seems to have survived. Sure you could point to the Bush years of lower taxation as a stellar example of the benefit of lower taxes. If you could find any vestiges of that time.

Group Forecasts Tax Bills Under Obama's Proposal - WSJ.com: "People with annual income of less than $10,000 would get an average $348 net tax benefit, and a 6.4% increase in their after-tax income."One teaspoon at a time.

Seriously, when someone making $10,000 per year gets an extra $348 per year, this is not a reason to feel like someone is stealing from the rich.

Example: $10,000 ATax Income (assuming no income tax at all)

Pre-Obama 0% Tax Rate, $833/month

Enter Obama: -3.4% Tax Rate, $886/month

Net Monthly Gain: $53 - the cost of a single person's weekly grocery run.

The biggest tax increases would fall on people making $500,000 to $1 million a year, who would see an average 3.4% reduction in after-tax income, and on people making $1 million and up, who would see an average 6.0% reduction in after-tax income.3.4% of $500,000-1,000,000 averages out to be $25,500 which is 250% more than the $10,000 example makes in an entire year.

Example: $500,000 BTax Income

Pre-Obama: 36% Tax Rate, $26,667/month

Obama: 39.4% Tax Rate, $25,250/month

Net Monthly Loss: $1,417 - 160% of the monthly income of the low-income example.

Sounds more like an argument for adding some kind of scale to accommodate living expenses for high cost areas. Although that sounds like a good way to create virtual gated communities using "cost of living" fences.

To put all of this into perspective:

Historical tax rates have been substantially higher, and this country seems to have survived. Sure you could point to the Bush years of lower taxation as a stellar example of the benefit of lower taxes. If you could find any vestiges of that time.

Comments